News

D&L Industries Reports 1Q19 Results

- Recurring net income of P748 million, 1% higher y-o-y, or EPS of P0.10

- Blended GPM expanded by 3.1ppts to 21%

- HMSP revenue share improved to 69%; margins at 25%

- ROE & ROIC stood at 17% and 21%, respectively

May 7, 2019 – D&L Industries’ recurring income reached P748 million, or earnings per share of P0.10, in first quarter of 2019 (1Q19). This is 1% higher than last year. Earnings before interest and taxes were higher by 4% at P990 million.

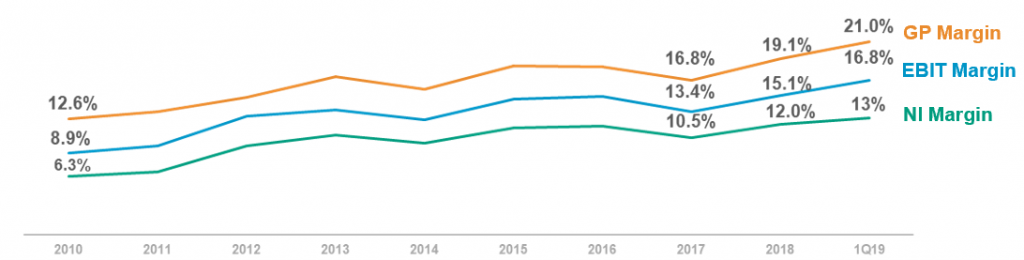

As a reflection of the company’s investments in R&D to move up the value chain, all four business segments saw their margins recover in 1Q19. This led to a 3.1-ppt expansion in overall gross profit margin which stood at 21% for the period.

In terms of sales mix, the company saw its HMSP (High Margin Specialty Products) revenue contribution reach a record high of 69% in 1Q19. The company continues to focus much of its resources in growing the high margin side of the business. HMSP margins also improved to 25%, up 1.3 ppts from the same period last year.

The commodity segment, accounting for 31% of total revenues, continues to see its margins at a favorable level. In 1Q19, the blended commodity margin stood at 12.7%, up 6.2 ppts y-o-y. This reflects the company’s efforts to consciously focus on margin-accretive commodity sales. However, given the nature of commodities, these double-digit margins are unlikely to be sustained.

Nonetheless, this segment remains a vital part of the company’s overall business, given the strategic role it plays in developing and growing the HMSP business.

D&L Historical Blended Margins

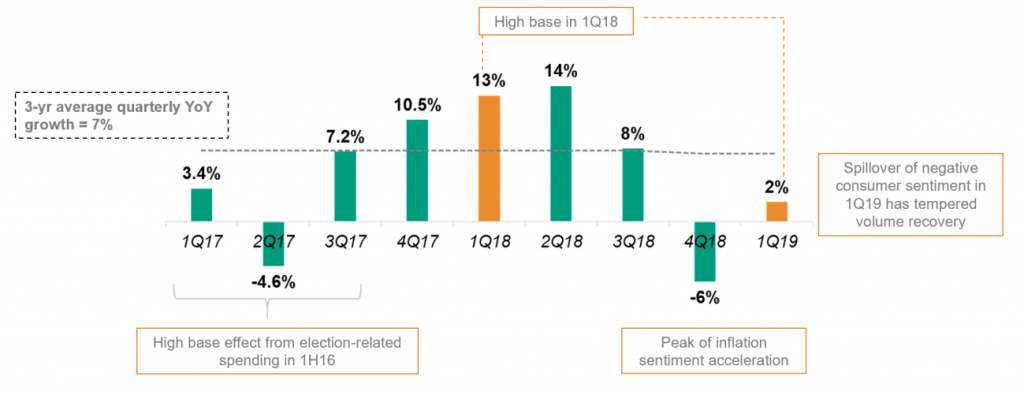

Meanwhile, volume recovery was tempered by macroeconomic factors that have continued to weigh down aggregate demand. In 1Q19, total volume for the company only grew by 2% y-o-y coming from a high base in 1Q18 where total volume grew by 13%, significantly above the historical average growth of 7%.

The negative consumer sentiment that restricted spending behavior last year has persisted in the first quarter of the current year. In addition, the delay in budget approval also resulted in government underspending which the Bureau of Treasury estimated to be as much as Php1 billion per day in the first quarter. Looking forward, however, positive economic developments such as 1) continued easing in inflation given the oversupply of key food items such as chicken, pork, fish, and even coconut oil, 2) anticipated ramp up in government and consumer spending, given the passage of 2019 budget and elections in May, and 3) a more accommodative monetary policy, should all translate to a better growth for the economy in general. D&L is well-positioned to benefit from this growth, with over 70% of our revenue coming from consumer goods manufacturers.

HMSP Historical Volume Growth (YoY)

Exports as percentage of total revenues stood at 19% in 1Q19. In peso terms, export revenues declined by 19%, mainly due to lower commodity prices which were passed on to customers. Coconut oil and palm oil average prices were down 43% y-o-y and 19% y-o-y, respectively. The company remains optimistic that it will reach its long-term target export contribution of 50%. The ongoing construction of its new plants in export zones is expected to be completed in 2021.

The company’s return ratios remain healthy. In 1Q19, Return on Equity (ROE) and Return on Invested Capital (ROIC) stood at 17% and 21%, respectively. Meanwhile, the balance sheet remains robust with net gearing at 11% and interest cover still comfortable at 11x. As of end-March 2019, net

debt stood at P1.9 billion with average cost of debt at 5.59% (inclusive of DST). The company generated negative free cash flows of P226 million for the period due to higher capex related to the expansion plan.

“We saw negative consumer sentiment from last year spill over to the first quarter. This, combined with government underspending, affected our volume growth. However, macroeconomic indicators show that the business environment will improve going forward,” remarked President and CEO Alvin Lao. “We saw our HMSP revenue contribution and HMSP margins reaching all-time highs – these are extremely positive developments as we further develop resiliency. As a company, we’ll continue to invest in strategic areas to continue maximizing value to our customers and shareholders. Moreover, we remain positive on our exports that will complement the growth of our domestic business.”

Food Ingredients

The food ingredients segment posted record high blended margins for the period, as both HMSP and commodity margins showed improvements. Blended margins expanded by 3.3ppts in 1Q19.

Meanwhile, total volume only grew 1% y-o-y, due to commodity sales dropping by 7% y-o-y. Nonetheless, the 9% y-o-y volume growth in HMSP food ingredients is encouraging, as it represents the continued strength of the recurring business. Total gross profit increased by 18% but lower forex gains and higher interest expense resulted in flat earnings for the segment in 1Q19.

Oleochemicals and Other Specialty Chemicals

Chemrez posted a 14% y-o-y increase in net income for the period. This was largely driven by the strong performance of the Oleochemicals segment which more than offset the flat performance of the Other Specialty Chemicals segment. Oleochemicals, for our purposes, are chemicals derived from coconut oil. These derivatives are mainly used in health supplements, raw materials for personal care products, and biodiesel which is an additive to diesel. Given the increasing appreciation of coconut oil globally, this segment continues to grow with volume increasing by 10% y-o-y and margins expanding by 7.8 ppts for the period.

Specialty Plastics

The specialty plastics group saw its blended gross profit expand by 1.4ppts in 1Q19. The 6.9-ppt margin expansion in colorants and additives has more than offset the 2.9-ppt margin contraction in engineered polymers. Despite a 7% drop in total volume, gross profit increased by 3%. Forex losses, however, wiped out this growth, resulting in a 2% drop in net income

Aerosols

Aerosols group saw its margins recover by 5.8 ppts for the period. However, total volume was down by 10% due to overstocking of some customers in the latter part of 2018. For instance, in 4Q18 alone, total volume was up 61% y-o-y. As a result, net income for the current quarter posted a decline of 5% y-o-y.

INVESTOR RELATIONS CONTACT

Crissa Bondad

Investor Relations Officer- D&L Industries, Inc.

+632 635 0680

crissabondad@dnl.com.ph / ir@dnl.com.ph